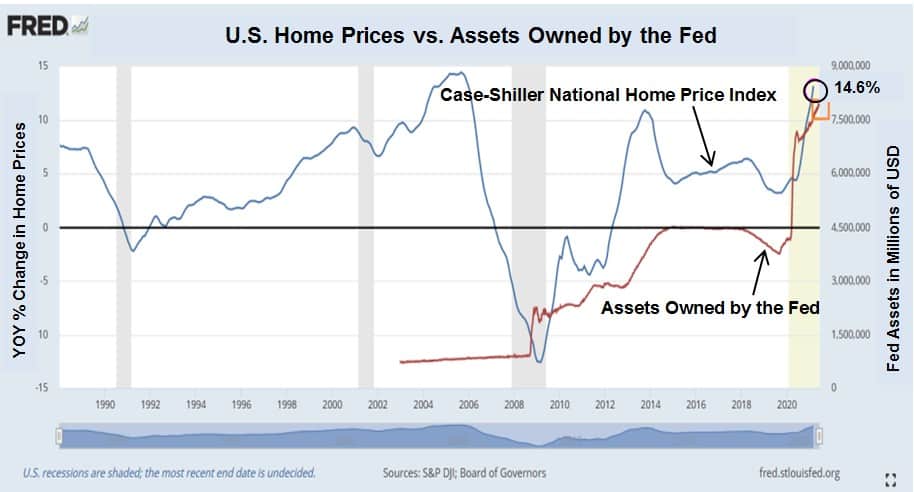

Following the extensive measures the U.S. central bank took in 2020 to contain the economic damage that resulted from the coronavirus, the Federal Reserve’s balance sheet grew to over $8 trillion in June 2021 – it’s highest level ever.

Even though the Fed’s balance sheet has nearly doubled since March 2020, the Fed said it will continue to buy Treasury and mortgage bonds at a pace of about $120 billion per month to keep interest rates low and support the economy.

How has this massive Fed stimulus

impacted U.S. housing prices?

In March 2020, the Case-Shiller National Home Price Index was rising at a 4.6% year-over-year rate.

In April 2021, it was rising at a 14.6% annual rate – its highest year-over-year gain ever recorded.

The lesson?

If you want to make money in the markets, Don’t Fight The Fed.

:::::

For details on my October 23, 2021 seminar, CLICK HERE.