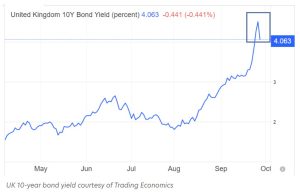

With inflation at 9.9%, the Bank of England (BoE) had to step in (i.e. “pivot”) yesterday with the stunning announcement that it would re-start Quantitative Easing in order to lower interest rates and save the British economy from collapse.

This was an emergency move by the BoE because leveraged pension funds were getting margin calls on their bond holdings that had lost 30-50% of their value due to the high rate of inflation.

The 10-year bond yield plunged from 4.65% to 4.06% on the news.

Will the Fed follow Suit?

For reasons explained here, I wanted to believe the Fed when they said they would keep raising rates to fight inflation – even if the end result was financial pain.

After what the BoE did today, I’m not so sure anymore.

Furthermore, with everybody’s eyes on Britain, people are overlooking the financial crisis that’s occurring in Europe.

Germany is in Trouble Too

With 10.9% inflation, pension funds in Germany are being forced to liquidate their bond holdings because its bond markets have also imploded.

People are wired to believe the future will resemble the recent past – but in reality, unexpected events occur all the time.

Markets don’t care if you win or lose. They do whatever they want – and it’s your job to adjust to them.

Welcome to the Hotel California everyone. As investors, you can check out anytime you want but you can never leave.

::::::