Bankruptcy filings tend to rise after an economic downturn starts.

But not in 2020.

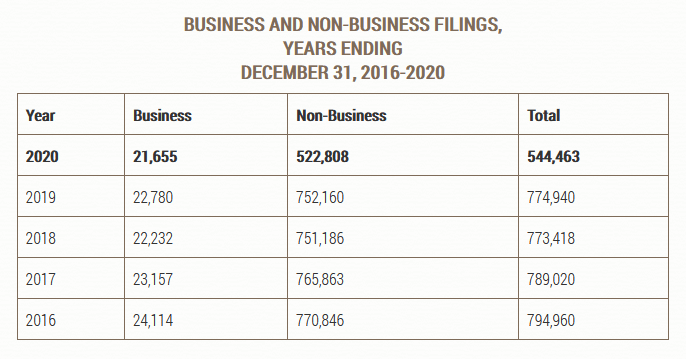

Despite the surge in unemployment due to COVID-19, the number of personal and business bankruptcies fell from 774,940 in 2019 to 544,663 in 2020. That was nearly a 30% fall according to the Administrative Office of the U.S. Courts.

This was the lowest number of filings since 1986.

Do you know why?

It because the Fed and US Government backstopped risk.

The government gave businesses money to pay it’s employees and moratoriums were put in place that prevented foreclosures REO sales.

In addition to that, Big Banks (like Wells Fargo and Bank of America, for example) received attractive Covid-19 bailout deals from the Fed.

To be fair, some bankruptcy filings may also may have been affected by pandemic-related disruptions to bankruptcy courts, many of which have had limited public building access since mid-March.

The U.S. economy, however, will eventually be weaned off of Fed and government life-support – so be ready for it.

“When the tide goes out,” says Warren Buffett, “we’re going to find out who’s been swimming without a bathing suit.”