Of course we do not live in the future, but investors have to be prepared for it.

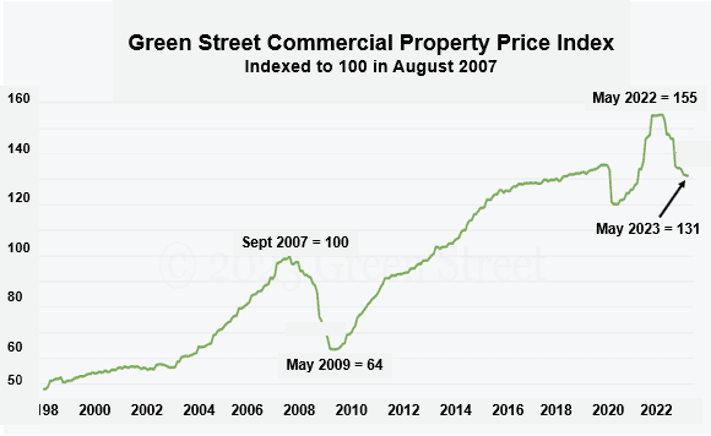

Commercial RE prices fell 37% during the last downturn as investor expectations became too high in Sept 2007.

And as is usually the case, when overly optimistic expectations are met with the reality that prices don’t go to the moon and stay there – a reversion to the mean occurs to bring valuations down to more earthly levels.

The above chart from GreenStreet.com shows that commercial RE prices are currently off 15% from their May 2022 peak.

Will the same 37% mean reversion

occur during this downturn?

No one can accurately make that prediction because no two cycles are exactly like.

But from the lofty levels that were reached in May 2022, a -37% (or more) decline would come as no surprise. That’s the nature of cycles.

But what we do know is that every battle for RE success is won before it’s fought.

To do that – and whether prices are going up or down – investors have to study history, be prepared for what is likely to happen next, and be more skilled than 90% of your competitors.

::::::