Market sentiment refers to the prevailing attitude of investors toward a particular asset class.

It is largely driven by price movement and crowd psychology (fear and greed).

Rising prices lead to bullish market sentiment – while falling prices lead to bearish market sentiment.

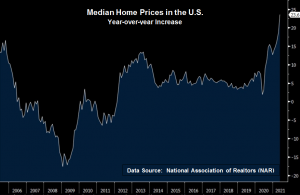

Currently, housing market bears are few and far between.

The reason is because the median sales price of a U.S. rose to an all-time high of $350,300 in May – up a whopping 23.6% from a year ago.

How to Prosper During Good Housing Markets and Bad

Whether an investor is correctly bullish or bearish on the housing market, success breeds complacency – and complacency kills.

The key to lasting prosperity is therefore adjusting to an ever-changing tomorrow.

Real Estate Tends to be a Leverage Investment

Investing successfully is more about managing risk than it is about maximizing profits.

While leverage and rising prices can lead to spectacular profits – leverage and falling prices can lead to equally spectacular losses.

“It is not the strongest of the species that survives,

not the most intelligent that survives.

It is the one that is the most adaptable to change.”

― Charles Darwin