[Taken from May 2023 Timing Letter]

Is the U.S. economy a dead man walking?

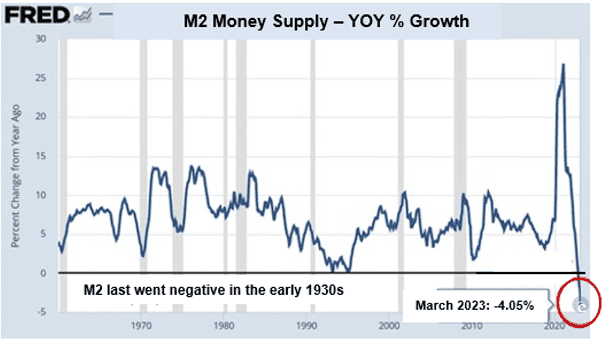

As illustrated in my May 2023 Timing Letter, U.S. money supply (M2) is falling at its fastest year-over-year rate since the 1930s, and is sending a highly negative signal for the economy, stocks, and real estate.

Historically reliable recession indicators have been going off for the last 15 months, but I found this one particularly alarming.

Here’s Why:

Growth in the M2 money supply has only gone negative on a year-over-year basis five times in the last 153 years.

- During the 1870s Depression, YOY M2 growth fell by 2% and the unemployment rose to 14%;

- During the Panic of 1893, YOY M2 growth fell by 3% and unemployment rose to 18%;

- During the 1921 Depression, YOY M2 growth fell by 2% and unemployment rose to 11%

- During the 1930s Depression, YOY M2 growth fell by 12% and unemployment rose to 25%.

The Art of Economic Survival

Like the art of war, the art of economic survival teaches us not to rely on the unlikeliness of a coming threat, but to be ready for it if it comes.

My suggestions?

Tighten your belt, ratchet down your spending – especially on things you don’t need with money you don’t have – increase your cash balances, deleverage, and be extra vigilant to where your money is invested.

It’s not called “panicking” if you’re one of the first people out the door.

::::::