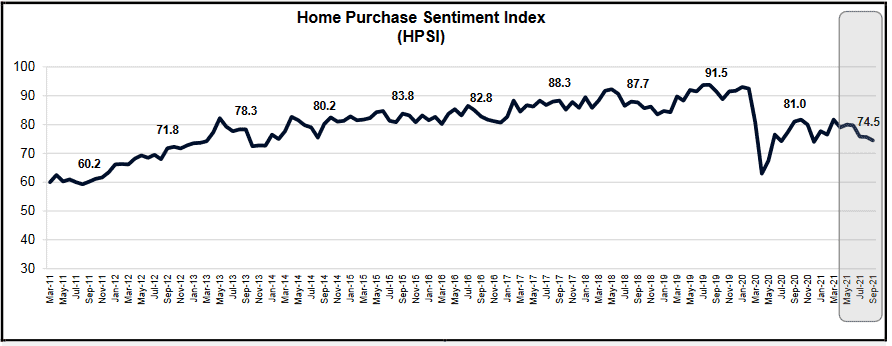

The Fannie Mae Home Purchase Sentiment Index is a composite index designed to track consumers’ forward-looking expectations of housing market conditions.

Because market psychology plays a significant role in determining price trends, this index can be used to make more informed real estate decisions.

Based on Fannie Mae’s national housing survey – which is conducted monthly – the Sentiment Index fell 1.2 points to 74.5 in September, a two-year low.

Home Buying Sentiment is Plunging

The biggest take-away in the September report was that 66% of all consumers surveyed reported that it’s a bad time to buy a home – while only 28% of respondents believed it was a good time to buy.

Even though Case-Shiller reported that national housing prices spiked to a record setting YOY rate of 19.7% in July, this was the greatest negative disparity on record since Fannie Mae started tracking buyer sentiment in September 2011.

My Thoughts?

When buyers and sellers eventually switch from playing offense to defense in this highly inflated housing market, Katie bar the door.

:::::::

October 23, 2021 Seminar: