Yeah sure it it. Tell that to my beagle.

I told him the price of the food he eats just went up. Again.

Fed Chairman Jay Powell believes that the current surge in inflation will prove to be “transitory” – and will begin to ease as the economic recovery matures and an initial burst of pent-up demand moderates.

While lumber prices are down 40% from their May highs, others – including my beagle – are skeptical.

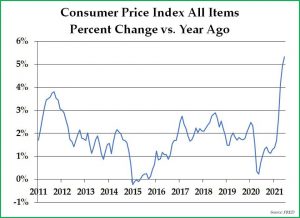

The Labor Department’s June consumer-price index was, by any measure, hot.

Total prices consumers pay for everything from food to haircuts to rent increased 0.9% in June – up from a 0.6% monthly clip in May.

Compared to a year earlier, total CPI jumped 5.4% in June – after rising at a 5% annualized pace a month earlier.

It always been part of the American past-time to complain about what stuff costs – “Man, prices are so high nowadays.”

But what I’ve observed recently is that more and more people are starting to worry about what stuff is going to cost in the future.

The new thinking is “if a can of tuna fish is going to cost $1.25 in a year, it’s better to load up now at $1.00 a can.”

This is what you should worry about. The psychology of inflation and how it can feed on itself and become self-fulfilling.

:::::::

October 23, 2021 Seminar:

“Is Inflation Knocking on the Door? Or Is Deflation?”

Only 41 Seats Still Available