[Exerpt from July 15, 2022 Timing Letter]

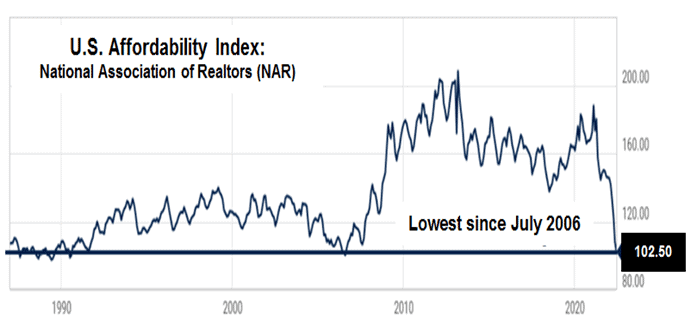

As reported by NAR, the U.S. Homebuyer Affordability Index for the nation fell from 124.0 in March 2022 to 102.40 in May.

That was the lowest reading since July 2006 – which was near the peak of the last housing bubble.

In the aftermath of that bubble, the Case-Shiller National Home Price Index fell 37% before prices finally hit bottom six years later (in 2012).

Driven by euphoria and record low mortgage rates, U.S. housing prices have risen by a staggering 40% since March 2020.

Fear and greed are addictive, which means what goes up fast can also come down fast.

Thus when this cycle turns, fear may serve as the same sort of accelerant to the downside as greed did to the upside.

::::::

“How I Stopped Worrying

and Learned to Love Inflation”