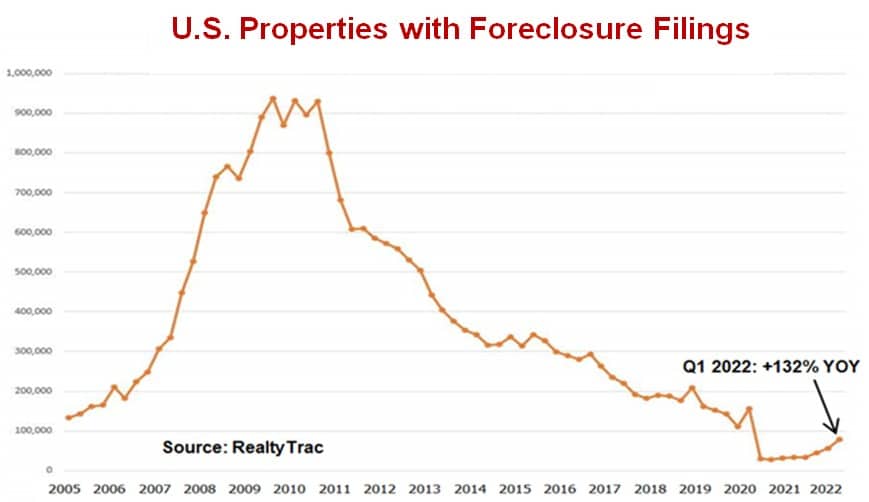

Due to the COVID pandemic, a nationwide moratorium was placed on Notices of Default (NODs) and Foreclosure Sales from early 2020 to late 2021 – which tainted the integrity of that data. I was therefore forced to stop inputting that data into my Real Estate Timing Model that is shown on page 7 of my Timing Letters.

Because the COVID moratoriums generally ended in late 2021, untainted NOD and Foreclosure Sale data is now flowing into my Market Momentum (MM) calculations for these two key indicators.

But Here’s the Catch

It will still take about 18 more months before the tainted data is completely purged out of the 24 months of data that is required to produce a trustworthy MM reading.

Once the MM readings for NODs and Foreclosure Sales are completely “market based,” they will be once again included in my Real Estate Timing Model. .

In the meantime, and for the first time in two years, I’ve decided to again include the MM charts for NODs and Foreclosure Sales in my Timing Letters.

::::::

“How I Stopped Worrying

and Learned to Love Inflation”