Market volatility is associated with big swings in either direction – and the housing market is considered tame when compared to the stock market.

However that wasn’t the case in 2020 with existing home sales – which is one of the best market timing indicators you can follow.

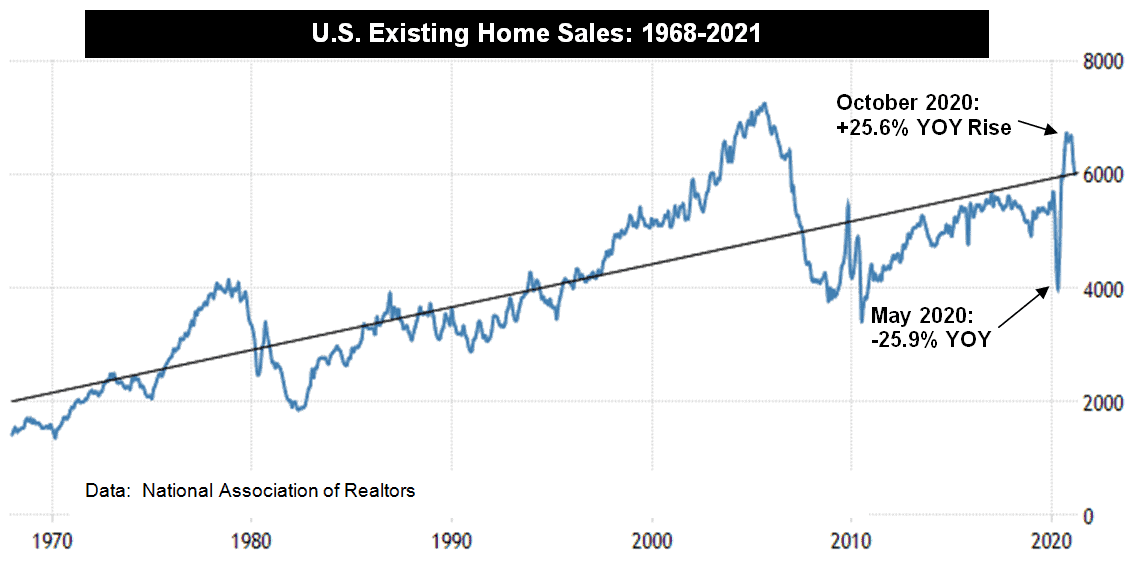

Home sales went from a highly negative year-over-year (YOY) reading of -25.9% in May 2020 – to a highly positive YOY reading of +25.6% five months later (in October).

That was the most volatility we’ve seen in this key indicator since at least 1968.

This proves that just like the stock market, the housing market can sometimes turn on a dime as well.

Probably in both directions too – which means you can never become complacent as a real estate investor.

He who sees trend changes first is the most successful.