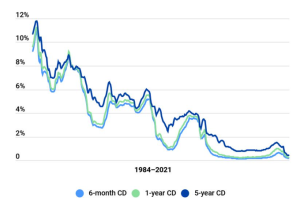

The Fed has been screwing savors for decades – but with inflation at 8.5% and rising, now it’s a real negative-yield bloodbath.

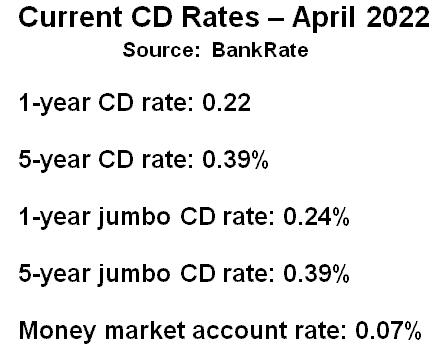

Savers use to get 5% or 6% in a Certificate of Deposit 20 years ago. With a $1 million, you could make $50,000 to $60,000 in interest per year without touching the principal.

Today that same $1 million will make you $3,900 per year in a 5-year CD – which is a return that is approximately 8.1% BELOW the current rate of inflation.

“The saver sees inflation making a mockery of years of thrift.” – The Federal Reserve Bank of New York

Of course the game is rigged – but to win, you have to take risks with your money.

Especially now or inflation will beat your brains out.