“It takes five years to learn how to make money …

and twenty-five to learn how not to lose it.”

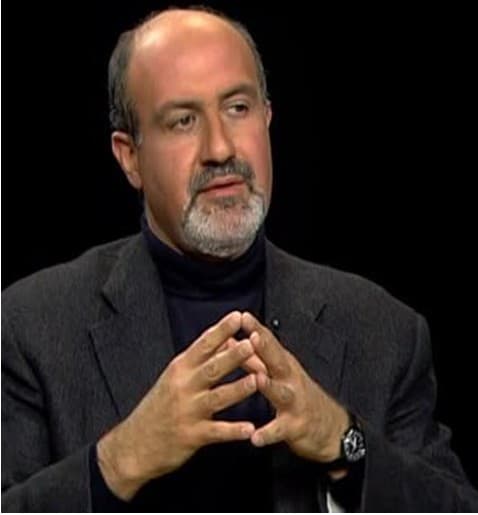

– Nassim Taleb

Whether a person realizes it or not, anybody who earns more money than he spends is automatically an investor.

The objective of investment is to store one’s excess purchasing power for future use – regardless how the money is put to use.

Due to inflation, a dollar today

is not worth a dollar tomorrow

That means you need to get a high enough return on the money you save today to make up for its loss of purchasing power over time.

I want to emphasize this because there are usually inflation-adjusted profits from real estate investments during times when prices are rising – and there are losses when housing prices are falling.

What makes a good real estate investor?

Successful real estate investment is therefore using your capital in such a way that its spending power is not only preserved but increases over time – in the form of cash flow or capital gains or both.

There is no finish line.

That’s why successful real estate investment is – and will always be – a never-ending battle for investment survival.

::::::